Uganda has significantly expanded its number of bank accounts from 6 million six years ago to a current total of 24 million, a reflection of its commitment to enhancing financial inclusion.

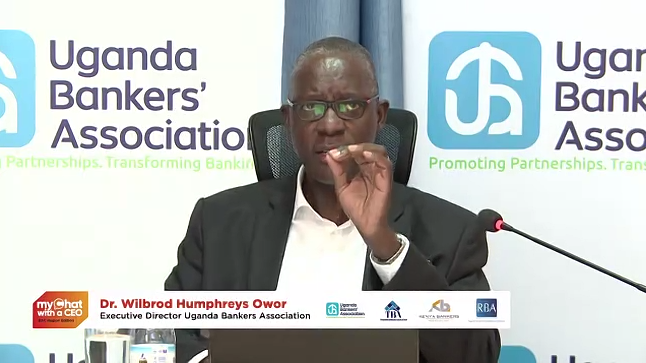

In a recent interview as part of the “My Chat with a CEO” series presented by the Kenya Bankers Association (KBA), Wibrod Humphreys Owor, Executive Director of the Uganda Bankers Association (UBA), highlighted the persisting cultural and religious perceptions at the micro-level that continue to impact financial and digital literacy levels in the country.

The “My Chat with a CEO” series, organized by KBA, serves as a platform for insightful discussions on current financial sector trends. CEOs from various banking institutions share information and receive feedback on multiple banking aspects.

The latest event, themed “Promoting Sustainable Financial Inclusion in the EAC Region,” featured CEOs from Bankers Associations within the East African Community (EAC). Dr. Habil Olaka, CEO of the Kenya Bankers Association; Ms. Tusekelege Joune, Executive Director of the Tanzania Bankers Association; Mr. Tony Francis Ntore, CEO of the Rwanda Bankers Association; and Mr. Wilbrod Humphreys Owor, CEO of the Uganda Bankers Association, engaged the public in discussions on strategies to deepen financial inclusion in the region.

Owor emphasized the importance of the financial products offered, pricing, and associated conditions, while acknowledging that technology plays a significant role in advancing financial inclusion. However, he also noted the challenges posed by issues such as cyber security and data privacy.

Let Us Build Your Online Success!

We are the experts in creating visually stunning and functional websites. With reliable hosting and exceptional customer support, we bring your vision to life. Join hundreds of happy clients who trust us!

Get Started Now📞 Call/WhatsApp: +256 207 800 192

Financial inclusion levels vary across East Africa, and Uganda has established a national financial inclusion strategy for 2017-2022. This strategy includes building infrastructure, developing digital assets and critical credit infrastructure, and promoting digital literacy initiatives to empower the population.

Uganda has made substantial progress in simplifying national identity processes, introducing new channels, and implementing national payments system regulations. The nation is currently in the second phase, aiming to expand its range of financial products, enhance consumer protection, address gender and youth issues, and develop a green finance market.

Owor also mentioned that Uganda has over 7 million inactive (dormant) accounts. He emphasized the country’s conservative approach to public borrowing and the importance of well-managed Eurobonds to avoid financial challenges.

Achieving financial inclusion, he emphasized, requires the active involvement of public sector bodies, private sector entities, and fintech companies. It is considered a crucial development index, and there is much work to be done.

Dr. Owor acknowledged the transformative role of fintech companies in breaking barriers and enabling institutions to provide services round-the-clock.