Summary:

- The NSSF ended the 2023/2024 financial year surpassing targets, with assets reaching Sh21.6 trillion. It earned UGX 39.8 billion in dividends, mainly from MTN Uganda, and highlighted strong performance in equity.

KAMPALA, (Examiner) – The National Social Security Fund (NSSF) has reported a strong finish to the 2023/2024 financial year, exceeding its set targets, according to Managing Director Patrick Ayota. Ayota indicated that preliminary analyses show the Fund’s key performance indicators are poised to surpass annual expectations.

“We’ve begun our annual audit and will update NSSF members upon its completion,” Ayota stated in a release.

Ayota highlighted that the Fund’s assets now amount to Sh21.6 trillion, surpassing its target of Sh20 trillion set for June 2025 well ahead of schedule in January 2024.

“Our success is a testament to the dedication of the entire NSSF team,” Ayota acknowledged.

The Fund, boasting approximately 2.2 million members, credited its robust investment approach, diversification strategy, and strategic asset allocation for delivering substantial value to its members. Ayota noted that the fixed income portfolio comprises 79.1% of total assets, with equity and real estate portfolios standing at 13.8% and 7.1%, respectively.

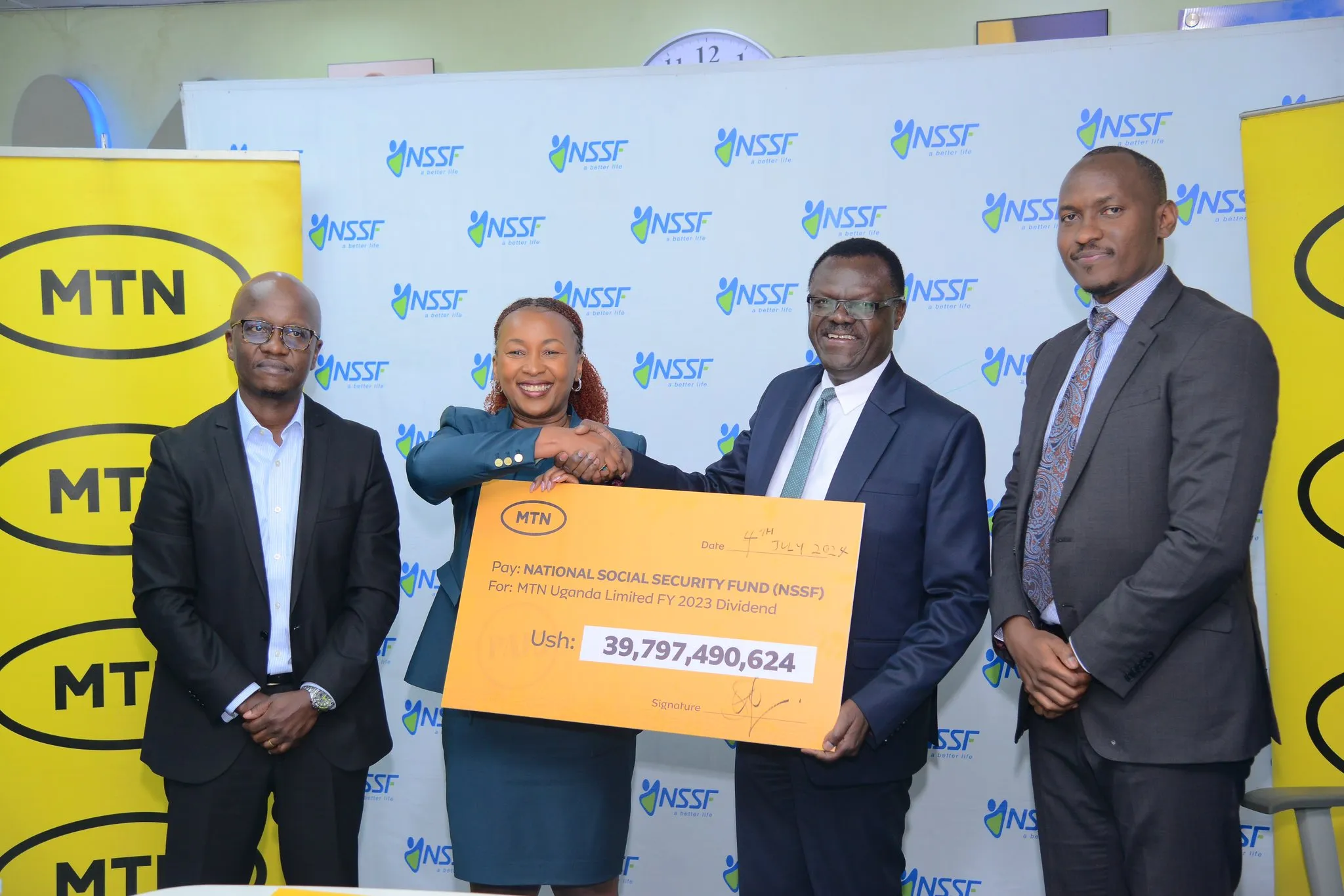

In the fiscal year ending December 31, 2023, the Fund reported earning UGX 39.8 billion in dividends, primarily from investments including MTN Uganda, marking it as the largest dividend earned from a listed company in the East African region this year.

Ayota emphasized, “MTN Uganda has not only been the top performer in our equity portfolio but has consistently delivered strong growth since its IPO, presenting a long-term growth opportunity for us.”

Sylvia Mulinge, CEO of MTN Uganda, highlighted the significant role of NSSF Uganda as its largest institutional shareholder, with an 11.7% stake in the company.

“We are delighted to celebrate the return on investment to our shareholders,” Mulinge stated, noting MTN Uganda’s continued positive performance and attractive dividends.

She announced that MTN Uganda had distributed its 7th dividend payment of UGX 6.4 per share, totaling UGX 143 billion, to registered shareholders via mobile money wallets and nominated bank accounts in June.

Mulinge underscored that the total dividend payout for the Financial Year 2023 represented a 13.2% increase from the previous year, totaling UGX 259.8 billion.

She also highlighted MTN Uganda’s recent secondary offer, which saw a 230% subscription rate, indicating strong investor confidence in the company’s strategic direction and performance.

“The oversubscription reflects appreciation for our strategy and continued positive performance,” Mulinge concluded.